As a dedicated saver turned professional investor, I’ve come to recognize the importance of making rational, data-driven investment decisions. In this pursuit, understanding cognitive and behavioral biases has become critical. My latest learnings have been around anchoring bias, one of the 315 behavioral biases I’ve found to be pervasive in my daily role managing HIT Capital, and advising super savers.

Anchoring bias refers to our tendency to rely too heavily on the first piece of information we receive about a specific topic. This “anchor” overly influences how we perceive all subsequent data thereafter.

I will delve into a specific example I suffer from weekly, and two prevalent examples I see my clients struggle with. At the end I’ll share a few tips, an ETF that profits from anchoring bias, and a couple tools I use in my investing process to make better decisions.

Stephen’s Anchor

Overcoming the Initial Stock Price

When evaluating a stock, I inevitably notice its share price. Despite taking considerable time, typically 48 hours to multiple years to finish an evaluation, the initial stock price remains embedded in my brain. Then each time I encounter the stock price, if it has risen from the initial price, I feel an urge to buy shares before it increases further, despite not yet having determined the stocks estimated value. This fear of missing out, anchored to an arbitrary number, should hold no sway over my decision to buy shares or not.

Clients (and Experts) Anchors

Overweighting Performance

Many investors anchor themselves to a stock or fund’s past returns when forecasting its future potential. They think outstanding historical performance will persist, disregarding new and upcoming headwinds. Conversely, they write off investments with poor past returns, even if the future outlook has improved.

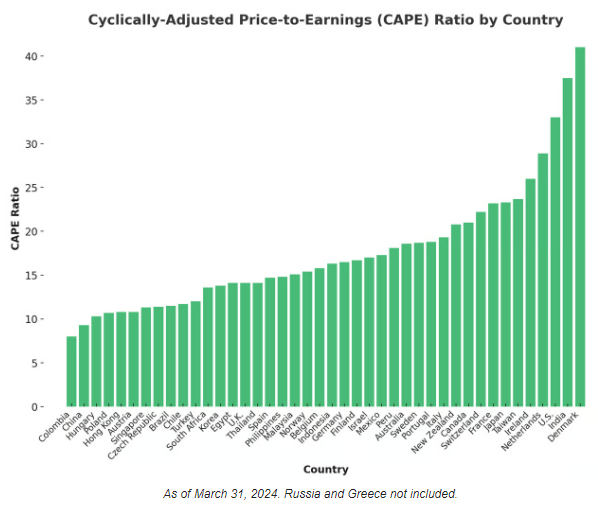

For instance, despite the S&P 500’s impressive 180% gain over the past decade, inflated prices and global market valuations suggest caution. The USA is now the third most expensive market in the world based on CAPE.

Yet analysts continue to predict the USA as growing stronger, achieving even higher earnings growth in the years ahead, 10.8% in 2024 and 13.9% in 2025.

Fixating on the Purchase Price

The most prevalent source of anchor bias I see is clinging to losing investments due to an emotional attachment to the purchase price. If my client bought a share for $100, and then had his goals change and needed to sell, but learns the share is $80, he or she is upset. This emotion is caused by them anchoring in on the initial price, which should play no role in calculating if they need to sell (unless factoring in tax consequences).

The real world examples of this type of anchor bias, combined with an aversion to loss range from a friend holding on to an extra home, to multiple clients retaining company stock. The rationale behind them continuing to hold is the desire to see their purchase price return to its original value.

Pull The Anchor, Don’t Set It

To combat anchoring bias, reassess investments objectively:

- Avoid fixating on your original purchase price:. Let your goals, fundamentals, situation, and alternatives guide your decision.

- Analyze current conditions and future prospects rather than relying solely on past performance.

- Update your thesis and estimated values as new information arises.

Understanding anchoring bias can lead to strategic advantages. For instance I built a scorecard for HIT Capital that houses each stock’s estimated value and I review it before making any buy or sell decisions.

Another example is building HIT Capital’s stock idea generation tool that is partially based on momentum, a strategy that has outperformed the market and is derived from investors overweighting performance. If you are not in HIT Capital, another option to access momentum is through Alpha Architects quantitative exchange traded funds (QMOM and IMOM).

Investing successfully requires an open, rational mindset. Be aware of anchors that cloud your judgment and keep you from making optimal decisions based on current data and evidence. If you are interested in reading more about different biases that interfere with quality decision making check out our blog here and subscribe to our new learnings here.

Leave A Comment