Reducing Regional and Political Risk in Your Investments: Overcoming the Backfire Effect

When it comes to investment decisions, our brains often cling tightly to existing beliefs, even when faced with conflicting evidence. For example, my daughter’s basketball team lost 18-0 last night, no joke, they didn’t score a single point 😯! But when I think about their team this morning, I still cling to my belief that they are great, a team capable of winning the league.

This behavioral phenomenon is known as the backfire effect, it causes us to double down on familiar but flawed ideas rather than reevaluate them. In investing, this effect can exacerbate biases to keep our investments close and local. Home bias, availability bias and overconfidence bias direct us to keep our portfolios exposed to unnecessary regional and political risks.

Recognizing and overcoming these biases is an essential key to building and sustaining a resilient investment portfolio.

The Dangers of Home Bias

Home bias, the tendency to invest predominantly in one’s home country, is deeply ingrained. We trust what we know and are drawn to our local market because it feels right. But as I discussed in my article, Home Bias: Is it Time to Take a Global Look?, this approach leaves us exposed. For example, a single change in leadership, tax policy, or trade regulation can make ripples across our entire portfolio.

Do you think the citizens of Ukraine, Russia, Mexico, Myanmar, Palestine, Syria, or Sudan thought they’d be at war? Are we any different than them?

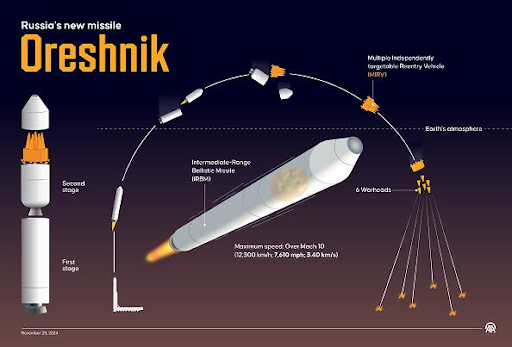

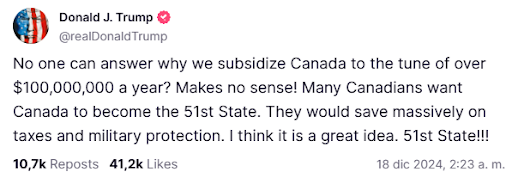

In the last two days Vladimir Putin threatened the USA with a missile “duel” and our president elect, Donald Trump, stated he wants Canada to be state #51.

Availability and Overconfidence Biases Amplify the Problem

Availability bias is another culprit. We tend to focus on markets and news stories that are readily available or memorable, leading us to overestimate their importance. Meanwhile, overconfidence bias, which I explored in Investors Avoid Winners: Availability, Attention & Overconfidence Bias, can make investors believe they have superior knowledge of their home market, discouraging global diversification.

These biases create blind spots, leaving our portfolios vulnerable. Even sophisticated investors like myself aren’t immune, just this week my research focus was on a growing Israeli company trading at less than 5x price to earnings. While I was translating Hebrew and diving in, I somehow found myself unintentionally researching multiple domestic micro-caps.

How to Reduce Regional and Political Risk

To mitigate these risks, we can take a purposeful and proactive approach:

- Diversify Globally: Expand your portfolio to include equities, bonds, and alternative investments across multiple regions. This reduces reliance on a single economic, regional or political environment.

- Embrace Objectivity: Use data-driven analysis to evaluate opportunities outside your comfort zone. Lean on tools and experts that can provide insights into markets and regions you’re less familiar with.

- Question Your Biases: Regularly review your portfolio and challenge your assumptions. Are you over-invested in your home country? Are there opportunities abroad that you’re overlooking?

- Rebalance When Needed: As markets shift, ensure your portfolio remains globally diversified. Don’t let short-term performance or news cycles sway your long term decisions.

By staying pro active and overcoming your behavioral biases, you can strengthen your investments and be better prepared for the unknown.

If that is you, but you don’t know where to start, check out this list of financial resources, of which now includes a free investment portfolio review.

Leave A Comment