The golden age of investing is here. The internet, discount brokerages, and free index funds have brought together a trifecta of investing bliss for DIY’ers.

My savings journey started 12 years ago when I retired from professional baseball and started work as an engineer. My initial thoughts as a saver was to find an expert in the field, a genuine financial advisor. Unfortunately, at the time I did not look in the right places, and the more interviews I did the sicker I felt. The research was leading me to believe financial advisors were no more than classed-up car salesmen, good for a free lunch but not worth taking advice from.

Luckily after 12 years of DIY investing my feelings for a select group of financial advisors have since adjusted and I realize the great ones can be worth every penny. But here’s the rub – they cost a lot of pennies! For many of us, there are significant advantages to DIY investing that can save you money without sacrificing returns.

10 Advantages of DIY Investing

Here are 10 advantages of DIY investing that you should consider before paying an advisor.

1. No Management Fee

DIY investors have a cost advantage from the start. If you invested in the S&P 500 over the past 50 years and paid a 1.5% management fee, your earnings would have been diminished by 47%. When the goal is compounding, costs matter. You can purchase a simple globally weighted ETF from low-cost brokers, such as Vanguard, Interactive Brokers, TD Ameritrade, Fidelity or Schwab at a fraction of the price.

2. Larger Investment Opportunities

You have access to a larger universe of investments than 99% of all financial advisors. Financial advisors are investment advisor representatives, which means they work for an investment advisory firm. Most investment advisory firms restrict the universe of investments available to their representatives. Even Vanguard, one of the most well respected and low-cost investment advisor’s chooses to restrict their client’s investments.

3. No Restrictions

There is minimal red tape or restrictions when managing your own money. Professional money managers must jump through a number of hoops. For example, as a licensed financial advisor I have had to pay more than 10 separate watchdogs and continue to manage additional paperwork, audits, and regulatory fees that add no value to my client’s portfolio. Many advisors pass these costs on to their clients through their fees.

4. Motivation and Aligned Incentives

It is natural to look out for yourself and family first. Only the best financial advisors structure their pay to naturally align with their client’s goals. Advisors can be incentivized to take positions and sell products that make them the most money, even if they are not in their client’s best interests. Stockbrokers, broker/dealers, and insurance agents who you may think are your friend and financial advisor are not required by law to act in your best interest.

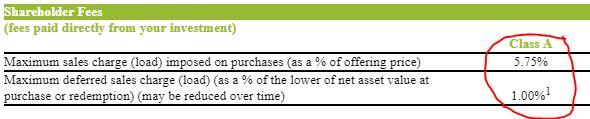

5. Eliminate hidden Fees

Advisory firms often have hidden fees that investors don’t even know they are paying.

- One of the tried and true strategies of financial advisors are to sell annuities, mutual funds, and insurance products where a portion of the fee is quietly kicked back to the advisor without the client’s knowledge. If you do your own research and buy your own products, you’ll never choose an option with hidden kickbacks.

- Soft-dollar exchanges. Your advisor or advisor’s firm may be receiving additional services through increased brokerage costs paid by you. These services may or may not benefit you, but you’re surely paying for them.

6. Income Not Correlated With Stock Market

Unlike financial advisors, your source of income is likely not also correlated with the stock market. DIY investors can ride out short term pressures, such as market downturns, and stay focused on their long-term goals. When the market is pressured, some advisors have a tendency to make changes that in the short term seem like a good idea but are actually harmful to the client’s long-term objectives.

7. Buy And Sell Without Headaches

You can buy and sell stocks without the worry of liquidity. Larger money managers can move the market when buying and selling small or illiquid stocks. This can limit their flexibility and ability to receive a competitive price. There are some advantages to being a small guppy in a large pond.

8. Simplicity

Simpler is often better. You probably have not memorized efficient market theory and complex equations based on the myth that volatility is synonymous with risk. You probably aren’t getting swept up into investment fads (i.e. Bitcoin, Annuities, and Weed Stocks) with the belief that because they weren’t volatile in the past then they won’t have the risk of loss in the future. Advisors can get caught up in upper-level financial theory that is not practical in the real world.

9. Immediate Access to Cash

If you have a short-term need, you have immediate access to your money. There is no middleman that may not answer their email, phone, or respond right away. (This could also be negative, which is discussed below)

10. Learn By Doing

The best way to learn is by doing. If you enjoy this blog, you are already halfway there. Spending just a little bit of your time researching the benefits of index funds and low-cost brokers can lead to significantly increased future returns. But….

The DIY Investing Catch

….do you have the plan and stomach for it? The number one drawback to DIY investing is that many investors panic in times of trouble (think the 2008 crash). The successful DIY investor has a plan and keeps following it in good times or bad. She may have an automated savings plan where the money comes out of her account every month, no matter what the market is doing. That money may be invested in a low cost, globally diversified ETF. What she doesn’t do is panic. She stays the course no matter what the market is doing and keeps her emotions in check. Then when it comes time to make a change, such as switching from her 100 percent equity allocation that began in her 30s to a more balanced portfolio of equities and bonds in her 60s, she makes the change once and then continues to stay the course all over again.

Do you have the plan and the stomach to be DIY Investor?

Leave A Comment