I was watching the baseball world series back in Oct of 2005 with some college buddies and during the pre-game I seemed to be the only one excited. The White Sox had a chance to make history by closing out the series in 4 games. As the night went on the excitement spread and by the end, we were all celebrating and caught up in the moment as the confetti flew and fireworks blew up. The White Sox finished the sweep, beating the Astros 1-0 and were crowned World Series Champions. My buddies, the city of Chicago, state of Illinois, and fair-weather fans across the world joined in on the celebrations.

Lottery Stocks and The World Series Champions

Much of the happiness, excitement, and pride I felt when the White Sox won the World Series is consistent with how you feel when owning a stock that skyrockets in price, referred to herein as a lottery stock. What we forget in the celebration is the winner drafts last the next year. We can enjoy the moment, but the prospects are rarely as bright as the recent past.

Don’t Draft Last and Expect a Better Outcome

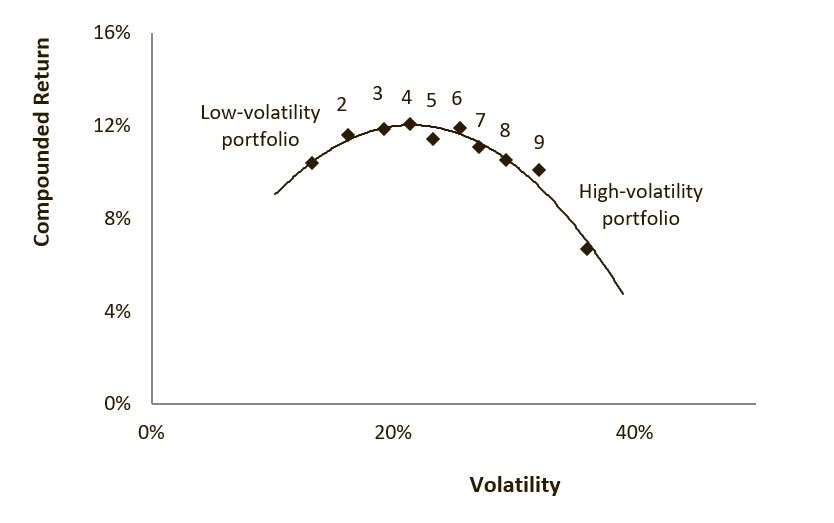

Historically, lottery stocks follow the same draft pattern as World Series Champions. They consistently have worse future price performance than their peers. The chart below displays the US stock market returns from 1929-2020 broken down by volatility. The lottery stocks with the highest volatility performed the worst. The good news is this poor performance is due to our behavioral biases and is something for which we can plan and adjust.

Why Lottery Stocks Pick Last

Three primary drivers behind lottery stocks’ future underperformance are: availability, attention, and overconfidence bias.

- Availability bias is the tendency to prioritize the most readily available information above the most pertinent or representative.

- Attention bias is the tendency to pay attention to some things while ignoring others.

- Overconfidence bias is the tendency to overestimate our ability to use that information wisely.

Your Bias at Work

Lottery stocks are similar to the champion’s merchandise after winning, they are both overpriced.

A lottery stock’s quick and upward price movement typically generates hype, news, and additional information because people are interested (attention bias), the more news on the stock the higher it is tracked and prioritized (availability bias), and the more people who see and take notice of the information (attention + availability bias) the more confident they become and the more likely they are to convince themselves (overconfidence bias) to buy it (action bias).

The attention, availability, and overconfidence bias, along with others (action, herd, fear of missing out, illusion of control and recency bias) all lead us to overreact and overbuy lottery type stocks. Most of us have fallen prey to this; I ordered a White Sox hat at double the normal price after the World Series win, and investors are doing the same when they buy a hot lottery stock.

Draft First, Not Last

If you’d rather draft first with your own stock portfolio you can follow a process similar to ours at HIT Capital or create your own. At HIT we remove lottery type stocks from our purchase queue by means of calculating the smoothness of the stock’s price path over the past 12, 9, and 6 months. If the stock’s path is not very smooth it doesn’t make it in the portfolio. If that’s too complicated, you could start with ignoring talk show hosts like Jim Cramer or your buddies’ hot stock tip.

Staying away from stocks with recent price spikes will increase your odds of a fruitful investing future (unless, of course, you are shorting, but that’s a topic for another time).

Learn more about investing strategies by signing up for HIT Investments Behavioral and Personal Finance Blog or HIT Capital’s partner reports here or email me at [email protected] to request access to my past HIT Capital memos here.

Research

Leave A Comment