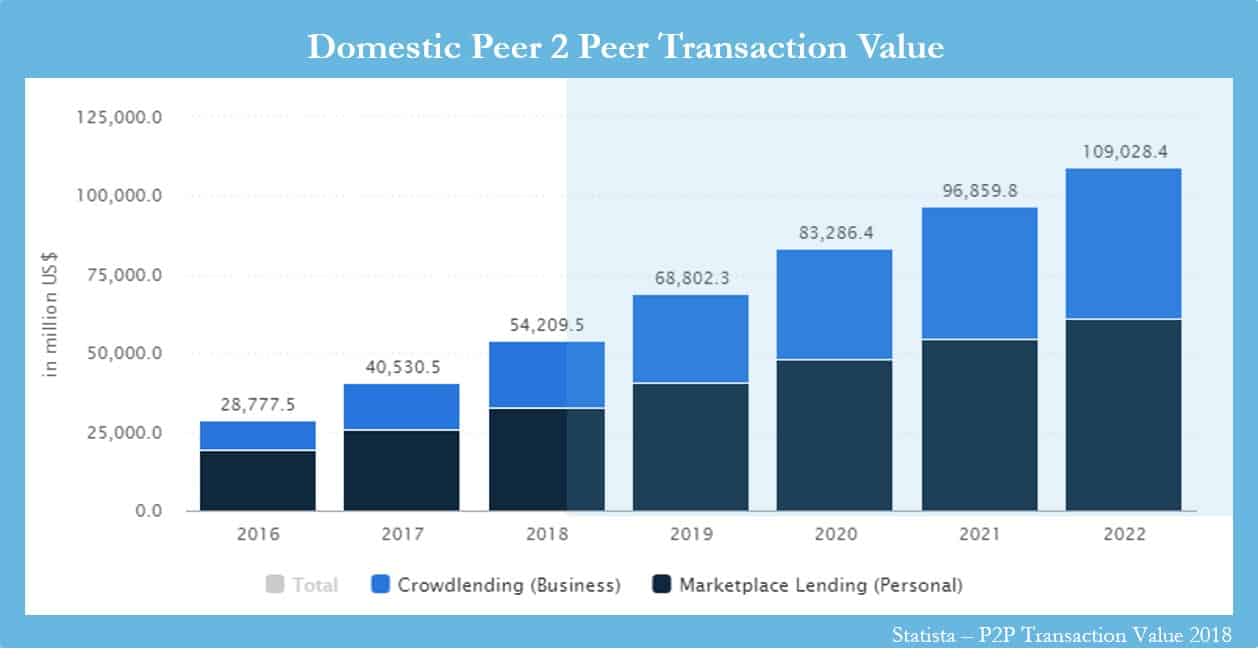

Financial innovation has opened a new and more efficient avenue to connect investors with borrowers. One of the technologies evolving since the mid 2000s has been the Peer to Peer (P2P) marketplace. Since their inception a decade ago they have grown from $0 to $54 Billion.

These P2P marketplaces are mostly online platforms that connect people in need of something with others in supply. Think of Craigslist and Facebook marketplace connecting buyers and sellers but in this case, the product being exchanged is solely money. At HIT, we are about living below our means and putting our savings to work, thus our focus will be on what P2P marketplaces means for investors.

To understand the opportunities as lenders we still need to understand the motives of the borrowers. A P2P platform’s success is derived from the borrowers needs and they have found tremendous success in specific niches, like house flippers needing quick access to capital or individuals wanting to consolidate credit card debt. The successful P2P platforms of the last decade are the ones that found a steady flow of borrower demand. The 3 most dominant categories are small business loans, personal loans, and real estate loans. We researched the robustness of each category and the ease for the individual saver’s like us to get involved and put our money to work.

The small business P2P marketplaces were the least developed of the three and tended to be only open to institutional and accredited investors. In combination with being an accredited investor, they had high account minimums. For example, Funding Circle required an initial capital commitment of $250,000. That is a large chunk of change to test out a platform, especially for us seeking financial freedom.

The real estate marketplaces Patch of Land, Peer Street, Lending Home, and others all shared in the requirements to be an accredited investor. But, many of the accreditation practices were self-confirming and did not require third-party proof. For example, Patch of Land allowed me to sign up, fund, and choose an investment within minutes of being on the platform. To go along with the self-accreditation process, I found the minimums to be much more reasonable. A few of the platforms allowed me to open an account and begin funding loans with as little as $1,000.

The last category of personal loans happened to be the most popular and most developed marketplace. Personal loan P2P’s are currently more than 57% of the entire crowdfunding lending platforms transaction value. When you combine increasing medical and educational costs with the American way of wanting more than you can afford, you end up with a hot personal loan market.

In aggregate, I associated the 3 categories of borrower needs into high risk, medium risk, and low risk. Personal loans carry the highest amount of risk as they are typically unsecured. Meaning the incentives for the borrower to pay in full are low and the recourse for the investor is minimal. Real estate loans are the opposite of unsecured and the majority have first lien rights to the underlying property. Some real estate P2P marketplaces like Peer Street do not even entertain loans greater than a 80% loan to value. The third category, business loans, fit between real estate and personal loans as they can be a combination of secured and unsecured.

I did find it unsettling that the riskiest category, personal loans, is also the most lenient in accepting our money. Prosper and Lending Club were the only lending platforms of the 43 I reviewed that did not require investor accreditation.

Upstart, another platform specializing in personal loans required accreditation but after I self-confirmed my accreditation and funded the account, they locked me into 9 different loans before I realized it.

A benefit was seen on the largest personal loan P2P marketplace, Lending Club, is that they have a secondary market for their loans. So, if you make a mistake and invest in loans you don’t want, as I did when researching Upstart, you can sell your loan to the highest bidder.

P2P marketplaces have been around for a decade and do not look to be going anywhere. They are continuing to grab market share from the brick and mortar status quo. After my initial pass, it appears P2P platforms are here to stay and have created a competitive alternative to investing in corporate bonds or other income-producing assets.

HIT’s next newsletter will continue the exploration of P2P marketplaces by diving into more than 43 platforms. Some questions I will be looking to answer are:

- Do the P2P’s pass on the efficiencies to us, the lenders?

- If I want income-producing assets uncorrelated to the stock market do P2P’s fit?

- Do the P2P’s compete with publicly traded bond funds?

Insightful post indeed!

You are completely right, As a peer-to-peer investor, you will lend your money out to individuals or businesses. You will have a say about what interest rate you want to earn. Make sure you always know what you are getting into before investing your cash with a peer-to-peer lender and weigh it up against other options.

So you are saying with P2P we get to be Shark in the tank?

I haven’t looked at it that way before, but I suppose the natural progression after becoming a saver is evolving into a shark. Choose your food/investments wisely 😉