Personal Finance

The Mailbag: 4 Steps to Improve Your Savings

The steady stream of questions and comments from interested readers has led me to the creation of a new HIT Investments Series: The Mailbag. Since I write for you, I might as well write about what interests you. The mailbag will be a recurring piece that responds to your questions, comments, and concerns. There will be no magic formula regarding what topics are covered. It may be that many of you are interested in one topic or it may be that one of you poses an interesting question or thoughtful comment. With that in mind, here we go: Q: I [...]

How to Make Money Work For You In 3 Simple Steps

While your savings rate gets you to the playoffs (the race for retirement), making it grow will win you the championship of financial freedom! That's why it's crucial that you learn how to make money work for you. A great way to grow your money is to invest a portion of it in the market, whether that be through stocks, bonds, real estate, ETF’s, mutual funds, or something else you believe will gain a positive return. Whenever investment professionals reference the idea of “making money work for you”, they are referencing the concept of investing your money in productive assets. [...]

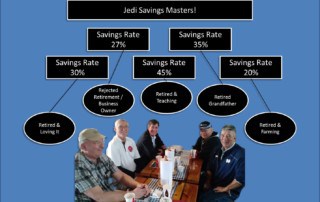

The Crave to Save, or Lack Thereof

If you are even remotely thinking about retirement, our guess is that you have heard a number of vastly differing opinions on what decisions will most impact the age at which you can retire. The primary lifestyle decision is whether you are, or going to become, a saver. The benefits that savers experience over the spenders and the borrowers are vast, “5 reasons to live below your means” can give you a glimpse of a few of those benefits. This may be a bit of a surprise coming from a hedge fund manager at HIT Investments, but your investment portfolio [...]

5 Reasons to Live Below Your Means

Living below your means is an essential step in your path to financial freedom. However, spending less than you earn goes against the consumer first culture we live in. Marketers do not profit from our financial well-being, they profit from our spending. Go against the grain, spend less, earn more and be happy about it. Here's 5 reasons why: 1. Reduce Stress According to one study by the American Psychological Association, finances are the leading cause of chronic stress in America. When you submit yourself to chronic stress your body releases adrenaline and other hormones. If this becomes a [...]

What is Liquidity? Mastering Financial Liquidity

Liquidity is the ability to quickly convert your investment into cash with little or no loss in value. This is important if there is a possibility that you will need cash in the near future. For example, a down payment on a new home means that you can sell the house later and turn it into cash. But a property like that can take a while to convert. However, assets like bonds or stocks can be turned into cash fairly quickly. Cash is the most liquid asset, while investments such as land or other sorts of real estate are less [...]

Risk – Who Cares?

If you are one of the 947 companies that rely on us (taxpayers) for a free ride, this newsletter is not for you; if you are a taxpayer without the bailout luxury read on and learn about two types of risk, tolerance and capacity. Risk tolerance is behavioral based and risk capacity is goal based, each type is different but equally important in the process to knowing your investment goals. Risk Tolerance Risk tolerance is the degree in variability of investment returns that you, the investor, are willing to accept. Anytime you invest, whether in large or small amounts, the [...]