In the last newsletter we discussed a few of the inherent consequences of dividends. This article compares the dividend to one of its alternatives, the stock buyback. Stock buybacks, otherwise known as share repurchases, occur when a business purchases shares of its outstanding stock from the shareholders. Importantly, the fundamental value of the business does not change. The result is an increase in the ownership percentage of each remaining share. For example, if a company has 100 shares and is worth $100, each share is worth $1 and has a one percent ownership interest. If the company buys back 50 shares, but is still worth $100, then each share is worth $2 and has a two percent ownership interest. This fundamental increase in proportional ownership has the tendency to increase price but not intrinsic value.

We can use the global leader in the beverage industry, Coca-Cola to compare stock buybacks to dividends. If we owned shares in Coca-Cola (KO) and they announced a 3% stock buyback program while having 4.35 billion outstanding shares, those shares would be reduced to 4.22 billion. Since Coca-Cola’s price/market cap is around $184 billion (as of 2/2016) the stock buyback would cost them about $5.5 billion. The fundamental value of Coca-Cola will not increase because the $5.5 billion in cash is no longer on their balance sheet. Each remaining share’s proportionate ownership increases by 3 percent as a result of the buyback and we (the shareholders) now own 3% more of the business. We can keep this extra 3 percent as equity in the business (a non-taxable event) or we can sell as many new shares as we wish if we want to generate current income (and a tax bill!). This transfer of ownership gives us the flexibility to do what we prefer with our portion of the $5.5 billion, rather than Coca-Cola.

Now let’s look at the same scenario if Coca-Cola decided to distribute the same 3% ($5.5B) as a dividend. When Coca-Cola pays out the dividend, its fundamental value decreases by $5.5B because it no longer has that cash. The shareholders brokerage accounts temporarily increase by $5.5B. The cash increase in our personal brokerage accounts now allows the Internal Revenue Service to request their portion (15% or $825 million). The end result is that the fundamental value of Coca-Cola was reduced by 3% due to the distribution of $5.5B in dividends but our after tax brokerage account only increased by $4.68B after taxes. This resulted in a net loss to us of $825 million.

The end result is that the fundamental value of Coca-Cola was reduced by 3% due to the distribution of $5.5B in dividends but our after tax brokerage account only increased by $4.68B after taxes. This resulted in a net loss to us of $825 million.

If you’re wondering, Coca-Cola’s dividend is currently yielding 3 percent. By distributing a dividend instead of a share buyback, the company is generating a tax bill for its shareholders to the tune of hundreds of millions. When a business has extra cash and decides it’s best to give back to the shareholders, it should be done through buybacks and not dividends. Increasing shareholder ownership would allow us to stay vested (the same as a Dividend Re-Investment Plan) but without the destruction of demand and value through premature taxation.

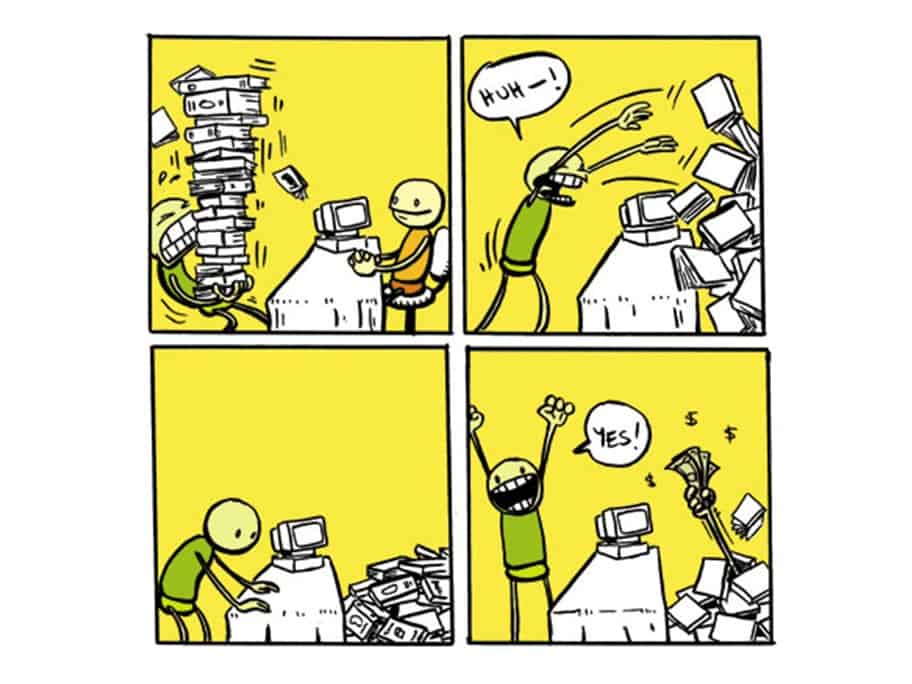

The Pickpocket cartoon was designed by Edna Spennato, and the Buyback came from greakshares

Hi Stephen. Good points made, but some confusion at the very end. What do you mean exactly by destruction of demand? Thanks.

Andrew, I am making a reference to the investors who pay taxes on their dividends. The destruction of demand would be an add-on effect due to the investors literally having less money in their accounts to invest.