When studying finance in preparation for the Series 65 exam there was an emphasis on specific investment objectives. The “safest” investment objective was “Preservation of Capital” and its primary goal was to prevent loss. Preservation of capital investments includes Treasury Bills (T-Bill), certificates of deposit (CD), savings accounts, and money market accounts (MMA).

These holdings are classified as the “safest” investments and are often insured against absolute loss. In industry lingo, they generate a “risk-free” rate of return. But before we take it as so, and solidify the link between “Preservation of Capital” and “risk-free” in our brains, let’s see if the data agrees.

Preservation Of Capital (savings accounts, MMA, CD, T-bill) Return

Since Preservation of Capital are “safe” investments, they generate a very low rate of return. In 2017, the 3-month T-bill paid out an interest rate of 1%. That was better than Switzerland’s interest rate of negative 0.75%, but in comparison to an inflation of 2.1%, it was still very poor.

Investing in the “safest” investments, generating a “risk-free” return, actually lost us 1.1% of our purchasing power. Holdings within Preservation of Capital protect us from absolute loss when the interest rate is positive, but they do not protect us from relative losses due to inflation and opportunity cost.

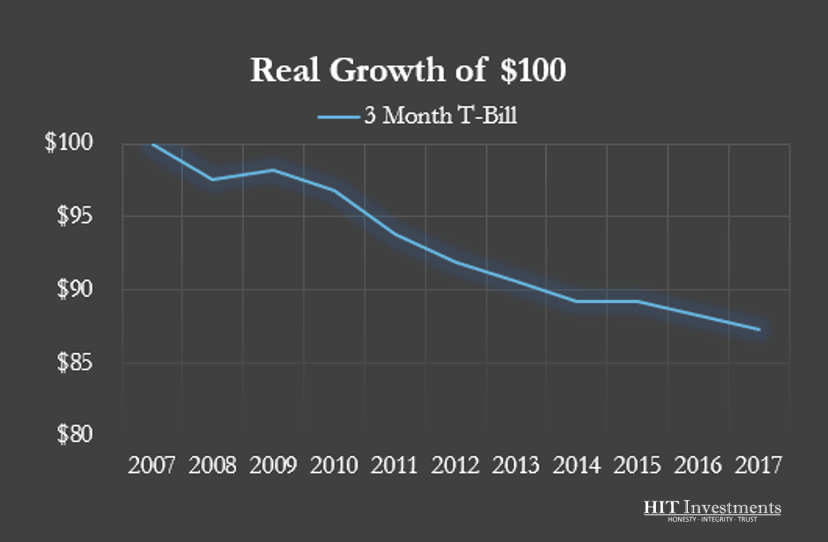

So the data showed that a T-Bill saver lost to inflation in 2017. What did a similar investment in T-Bills look like over the past 10 years? Unfortunately for the saver, 2007 to 2017 resulted in a real loss of 13%!

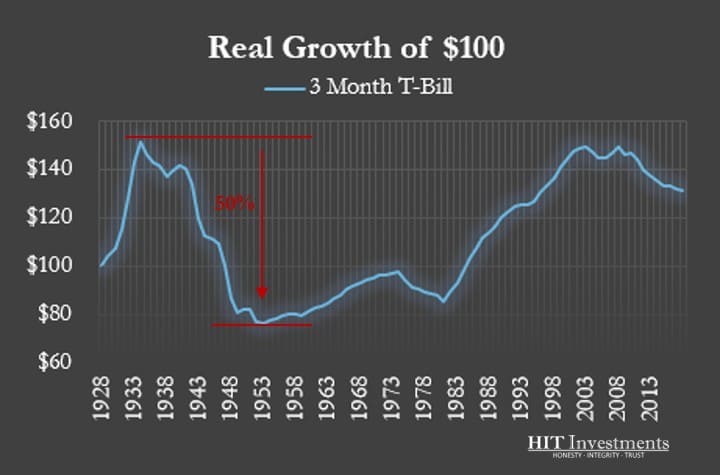

Ten years could be viewed as a relatively short time period if viewed from our grandfather’s eyes. Safe investments, specifically T-bills have been around for 90 years, so we extended the backtest to 1928.

The result was similar but not exact. Over the past 90 years, 35 of those years lost money, just as we experienced in the last 10. While the last 10 years lost 13%, there was a period where the T-Bill saver would have lost 50%! But over the full 90-year period we did not lose purchasing power. The initial investment of $100 grew to an inflation-adjusted $131. That relates to a 0.3% real return per year.

Is a Preservation of Capital Strategy Ideal?

In conclusion, Preservation of Capital, and more specifically T-Bills have kept up with inflation over the long haul. But don’t be fooled by the Wall Street lingo of receiving a risk-free return. There is no free lunch, and investments categorized within Preservation of Capital are no different.

This is even truer today when “safe” returns are worse than expected inflation. In 2017, inflation was 2.1% compared to a T-Bill return of 1% and the most common savings account return of 0.01%. The gap has narrowed in 2018, but the gap still exists and it’s not yet in favor of the saver.

Ensure you are investing and saving wisely, the “safe” place may not be as safe as you once thought.

Leave A Comment