If you are even remotely thinking about retirement, our guess is that you have heard a number of vastly differing opinions on what decisions will most impact the age at which you can retire. The primary lifestyle decision is whether you are, or going to become, a saver. The benefits that savers experience over the spenders and the borrowers are vast, “5 reasons to live below your means” can give you a glimpse of a few of those benefits. This may be a bit of a surprise coming from a hedge fund manager at HIT Investments, but your investment portfolio (and the choices that go into building that portfolio) is not typically the primary factor in early retirement – it is your savings rate.

Your “savings rate” is the difference in how much money you take home compared to how much you spend. If you make $50,000 per year after taxes and spend only $25,000 per year, your savings rate would be 50%.

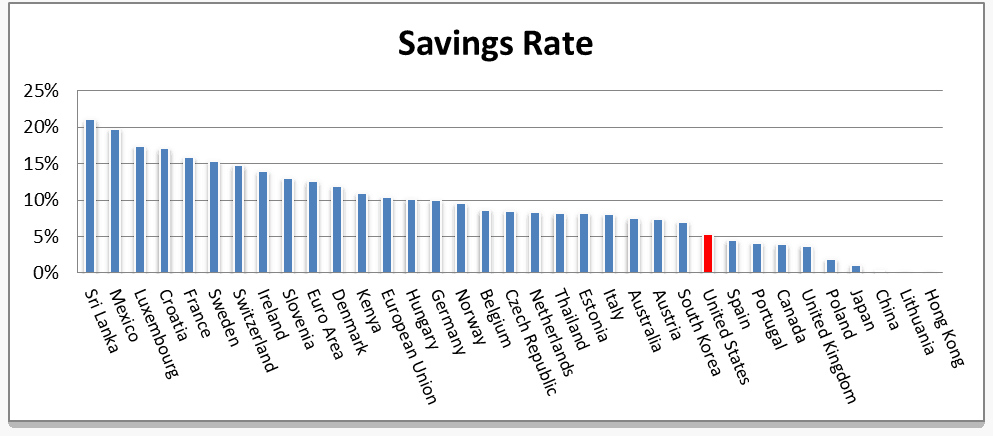

The presumption that because the United States is a world economic superpower that we must also be a world leader in savings rate is unfortunately nowhere near true. In fact, we are in the statistical savings rate dumpster. Mexico our friend to the South saves four times more per paycheck than we do! Check out where we stand:

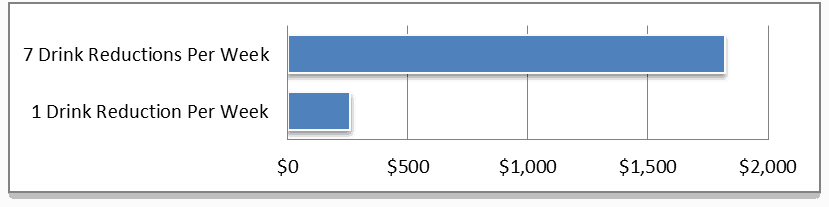

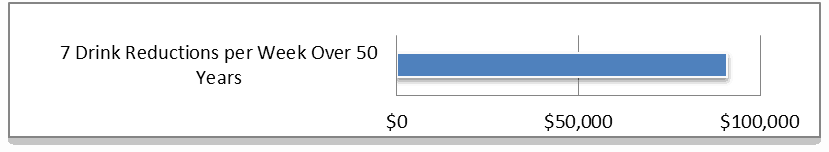

So how do we diverge from the norm and stay out of the American savings rate dumpster? The first key is to increase your savings rate today by reducing your expenses. For example, if you were to cut one $5 coffee per week out of your normal spending habits, you would save an extra $260 per year; if you cut out 7 coffees per week you would save an extra $1820 per year.

If you were able to sustain a $5 coffee reduction 7 days a week for the next 50 years the savings are huge.

The small sustained lifestyle change of reducing one drink a day adds up to more than two years of the average American’s take home pay. That translates into the ability to retire two years earlier!

The second key is to avoid a “lifestyle creep.” Things we didn’t “need” when we were making $50,000 a year but now “need” because we are making $100,000 per year. For example, many of us got our first jobs and soon after our first new car – a decent looking Honda Accord at about $20,000. Our first car lasted through a good number of raises and bonuses. When the time comes for a new one, are we going to stick with the now $25,000 Honda or are we going to go for the $50,000 Acura? Or worse yet, are we going to leave our Honda before its useful life is up and get that $70,000 Mercedes? This isn’t just about big ticket items either. “Lifestyle creep” shows up in our grocery budgets, our entertainment budgets, our clothing budgets, and pretty much on every other budget line item. It’s not that we shouldn’t enjoy our hard earned cash; but the smarter we are with it today, the better off we will be in our future retirement when we actually have time to drive that nice car around town rather than just to and from work every day.

It may seem that this article was a little harsh on the Homeland; but one nice thing about America is the freedom we enjoy. You have the freedom to spend your income as you see fit. It’s your choice; would you rather retire early or enjoy your cup of Joe in your newly leased Mercedes?

Subscribe here, the next newsletter will explain the power of combining your savings rate with an investment portfolio to harness the power of compounding.

References:

World Savings Rate Source: US Bureau of Economics | Trading Economics

Thank you for publishing this fantastic post. I’m a long time reader however I’ve never been compelled to leave a comment.

I’ve bookmarked your site and shared this on Twitter.

Many thanks again for a great article!