When reviewing the stock market to gain insights into the future I prefer to use two tools or let’s say lenses. The first lens is a magnifying glass of which I attempt to see what the market is doing today, tomorrow or next week. The second lens is a set of bifocals of which I use the magnifying portion to focus in on the market’s value today, and then with that knowledge I look up through the distant lens to see the market further out.

Magnifying Glass

What is the market going to do today, tomorrow, or next week? This is the trillion dollar question I am asked the most. I have tried to look through the magnifying glass many times but when I hold it up to my eye instead of seeing things clearly everything is a blur. There is just to much information I am trying to focus on at once to know what to make of it.

I’ve looked for people who might have this gift, but I have come up empty. If there was a gifted market timer I’d expect to see him or her as one of the richest people in the world. So, I checked again when researching for this article and only one of the top ten richest people in the world was a professional investor, and that was Warren Buffett. Warren’s latest statement pertaining to market timing was at Berkshire Hathaway’s 2022 annual shareholder’s meeting and he said, “We haven’t the faintest idea”.

Taking Warren’s word for it wasn’t quite enough for me so I looked through numerous research reports over the years and have continued to come up empty. I did learn of short term market outlook tools but none that work consistently and or were available to retail investors.

Valuations

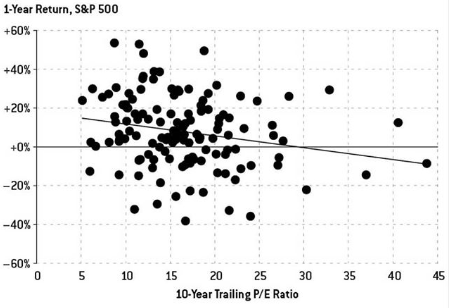

My favorite market outlook tool that is available to all of us is valuations, but even valuation struggles as a quality signal in the short term. In Nate Silver’s book “The Signal and the Noise: Why So Many Predictions Fail — But Some Don’t.” he shared the following chart. On the y axis we have the 1 year stock market return and on the x axis we have the 10 year trailing price to earnings ratio.

The chart looks like a machine gun spray hardly giving us a quality and actionable signal over a one year time frame, let alone one week or one day.

The Bifocals

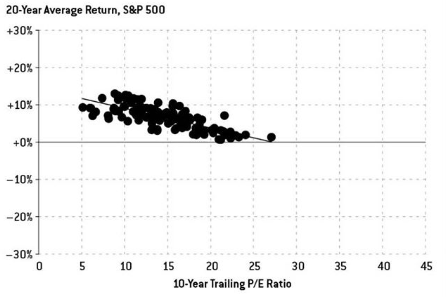

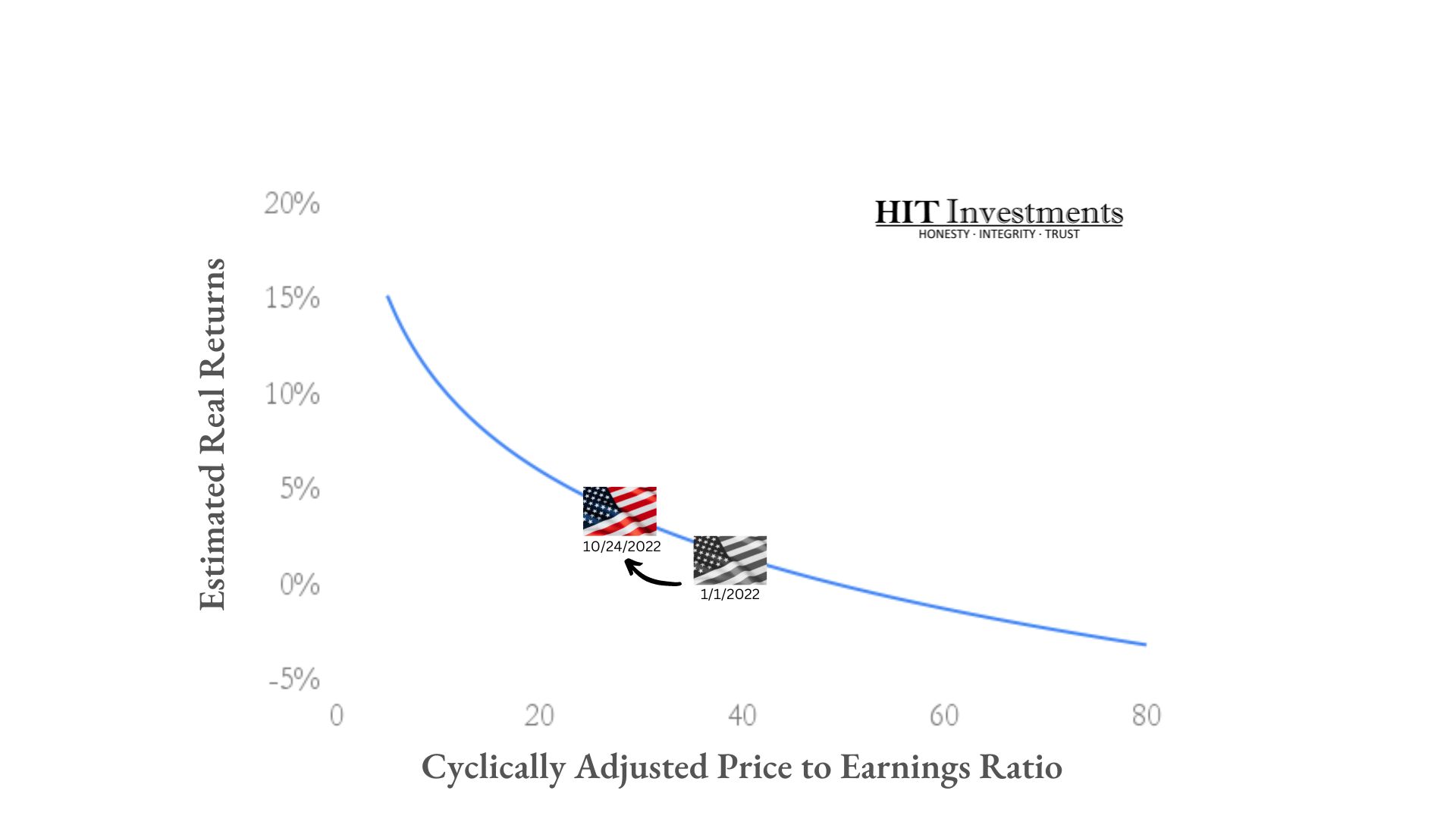

Using a magnifying glass was a failure so let’s grab our pair of bifocals. We use the now, or magnifying portion of the glasses to note the current prices people are paying for a specific amount of profit (value). But instead of using this valuation to figure out what the market is going to do tomorrow or over the following year we use it to estimate what the market is going to do over the next 5,10 or 20 years.

How Do The Bifocals Work?

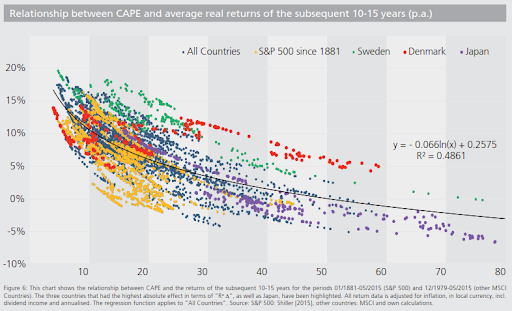

The cyclically adjusted earnings or CAPE is my valuation metric of choice for the general markets and estimating future performance. We can take the line of regression off of my favorite valuation research report by Star Capital (chart below). Star Capital used data from 17 markets dating back to 1881 and they compared each country’s market CAPE to their ensuing 10-15 year average return.

Using this report’s data and their line of regression we can plot the current S&P 500’s CAPE and 10-15 year estimated return (chart is below). But before you look at the chart below, take another look at Star Capital’s chart above and be aware that this is still a form of art versus exact science. The line does not go through every data point. When I interpret this bifocal view it is telling us the lower the price (CAPE) the greater the return, but it does not guarantee it.

What Are The HIT Bifocals Seeing Today?

The S&P 500 had a CAPE of 37 on January 1, 2022 and on Oct. 28 2022 the S&P 500’s CAPE had decreased to 28. This moves the S&P 500 up the respective line of regression and results in an increase in annual expected returns from 1.7% to 3.8% over the next 10-20 years.

Historically speaking the market is still expensive. The historical average CAPE valuation is 17 and the current market’s CAPE is 28, which is still a 39% premium. This brings the USA to an estimated future return of almost 4% per year but as we learned from the scatter of data our predictions are not foolproof and no market is protected from bankruptcy or a run up. So as you add these bifocals to your investing toolbox, recognize their limitations at the same time and the need for other tools like diversification for instance.

In conclusion, I would keep the bifocals in your investing toolbox, and leave the magnifying glass in the science lab. If giving up the magnifying glass is too hard, check out this article on loss aversion and see if one of those sneaky behavioral biases is what’s holding you back.

Leave A Comment